Double Your Bitcoin Buying

Power - With No Margin Calls

Borrow responsibly, grow your BTC with 1:1 co-investment, and stay fully in control with interest-only payments and the ability to redeem anytime.

Why BTC I-LOC Is Different

Your co-investment is matched 1:1. If you put in $500, Binaxity lends $500. Giving you 2× BTC exposure instantly.

Your Bitcoin is never sold automatically, even if the market drops. No LTV thresholds. No liquidation prices. Just simple, predictable borrowing.

Your loan is open-term. You can redeem your BTC at any time. Proceeds simply reduce your outstanding balance. No penalties, no lockups.

Make every dollar work harder

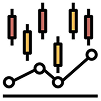

What is an Investment Line of Credit (I-LOC)?

An I‑LOC links every dollar you borrow to building a long‑term investment. With BTC I‑LOC, each approved draw is automatically used to buy Bitcoin and held with licensed custodians, administered through institutional‑grade infrastructure. You are building an asset, not just carrying a balance.

Why BTC I-LOC Is Different

1

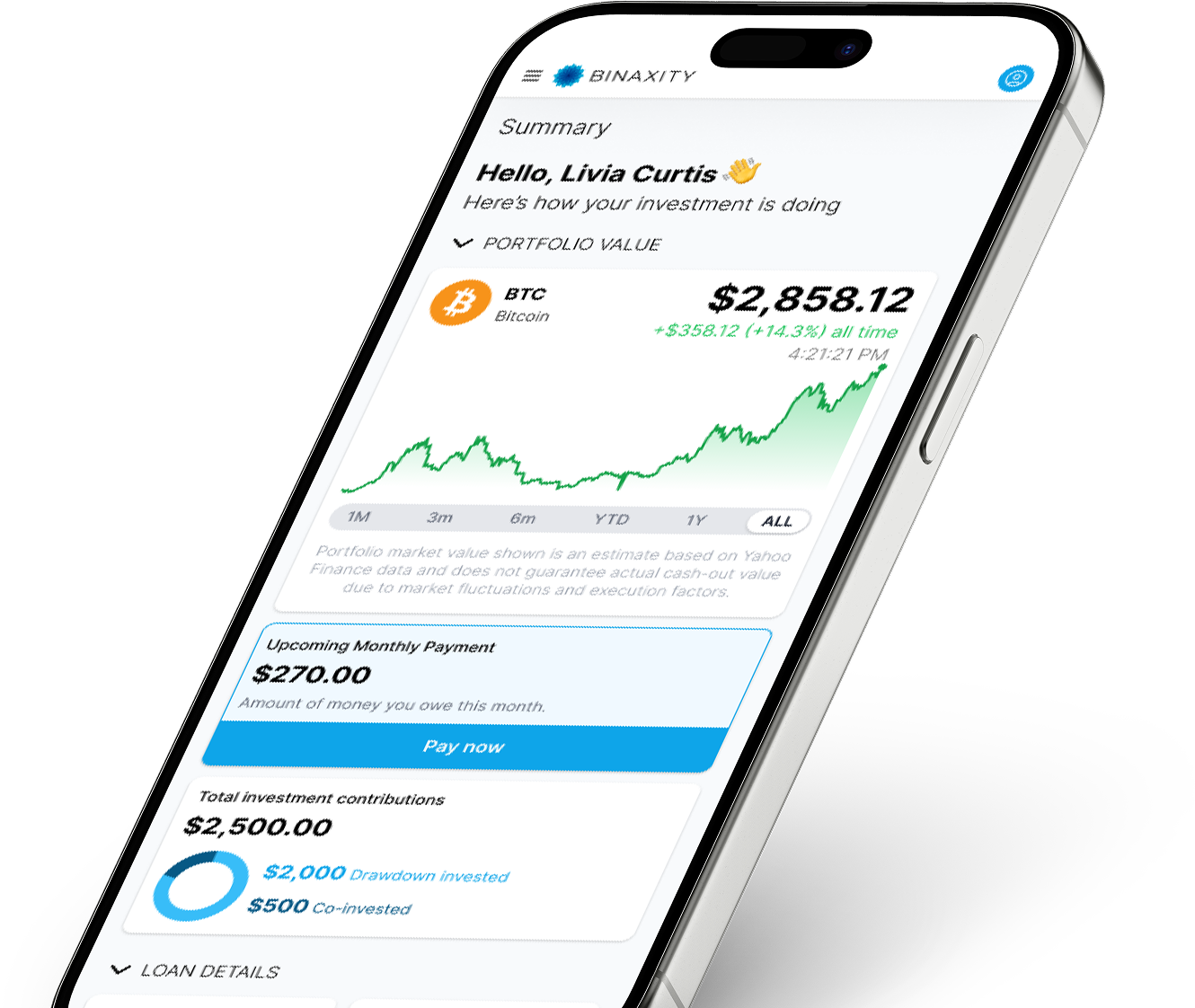

Apply and activate your credit line

Get a personalized credit limit, review your terms, and activate your line with your first draw.

2

Choose how much Bitcoin you want to accumulate

Decide how much to draw anytime. Each draw is matched 1:1 — if you invest $500, we lend $500, and $1,000 of BTC is purchased for your vault.

3

Your BTC is purchased and securely held

Your combined co-investment + loan draw is automatically converted into Bitcoin within hours and held with licensed custodians.

4

Pay simple interest — no principal required

Make low, predictable monthly interest payments. No amortization schedule. No balloon payments. No forced early repayment.

5

Stay protected — no margin calls, redeem anytime

Your Bitcoin is never liquidated due to price drops. You control your position: redeem BTC anytime (proceeds first reduce your loan), or continue accumulating long-term.

Try Our Wealth Time Machine

Try common examples like $10k, $20k, or $30k.

Go back in time to 2015 or choose a recent year.

Why an Investment Line of Credit?

Use credit to build long-term assets - not consumption. BTC I-LOC turns borrowing into structured accumulation.

No margin calls. No forced sales. Unlike margin or collateralized loans, your BTC remains secure.

Interest-only. Redeem anytime. Grow your position at your own pace with full optionality.

The Compound View

Insights on credit, investing, and modern wealth-building. Demystifying how structured borrowing and smart portfolio strategies can work for you.

![[SANDBOX] Co-Investment: The Secret Ingredient in I-LOC](https://images.ctfassets.net/b7ocqx1mczwt/z9g47bqfwt40ndwtid39G/0e40c9dab5bb8c81ef1af19e858fb037/image.png?fm=webp&w=700&h=438&q=50)